How To Make Use of Debt Wisely To Leverage Your Property

Chinese New Year is coming right around the corner, for the Chinese, this is the best time for us to go back to some of our friends, colleagues, and family members that owed us money, to remind them to return it to us.

As the Chinese saying goes, if you owed someone money and did not return it to them before the new year, you are going to be unlucky for the year to come. One entire year of bad luck! This will miraculously cure the selective amnesia that has been plaguing them for the entire year. You will also learn the lesson to be selective on who you extend a loan to.

As far as I know, this practice came from a tradition where paying off all debts before the New Year symbolises “closing the books” and beginning afresh the next year.

Clear your debts before Chinese New Year to have a Prosperous Year Ahead!

Other than this, I have also been hearing from my elders that being indebted to someone is bad and you should not owe anyone money. If you borrow money from others, it means that you are not doing well and will portray to others that you are incapable. It also means that you take no pride in yourself and have no sense of shame.

The elders will all say that if you don’t owe any people money, it means you are doing well and do not need to borrow money from people. That somehow means being successful to them.

Are you someone who still holds this mindset?

Proud to be Debt Free! (Picture Courtesy of Pinterest)

Can you not be indebted to anyone?

Consider our modern age and what this will look like for an average Singaporean if he does not owe anyone any money, at all.

Not being indebted to anyone means he would not be able to have a credit card. Having a credit card means being indebted to the credit card company, as they pay for your expenditures before you pay them back at the end of the month.

It would also mean that you cannot subscribe to any postpaid services, like your mobile phone subscription. They allow you to use their service first, before paying them at the end of the month. Indebted.

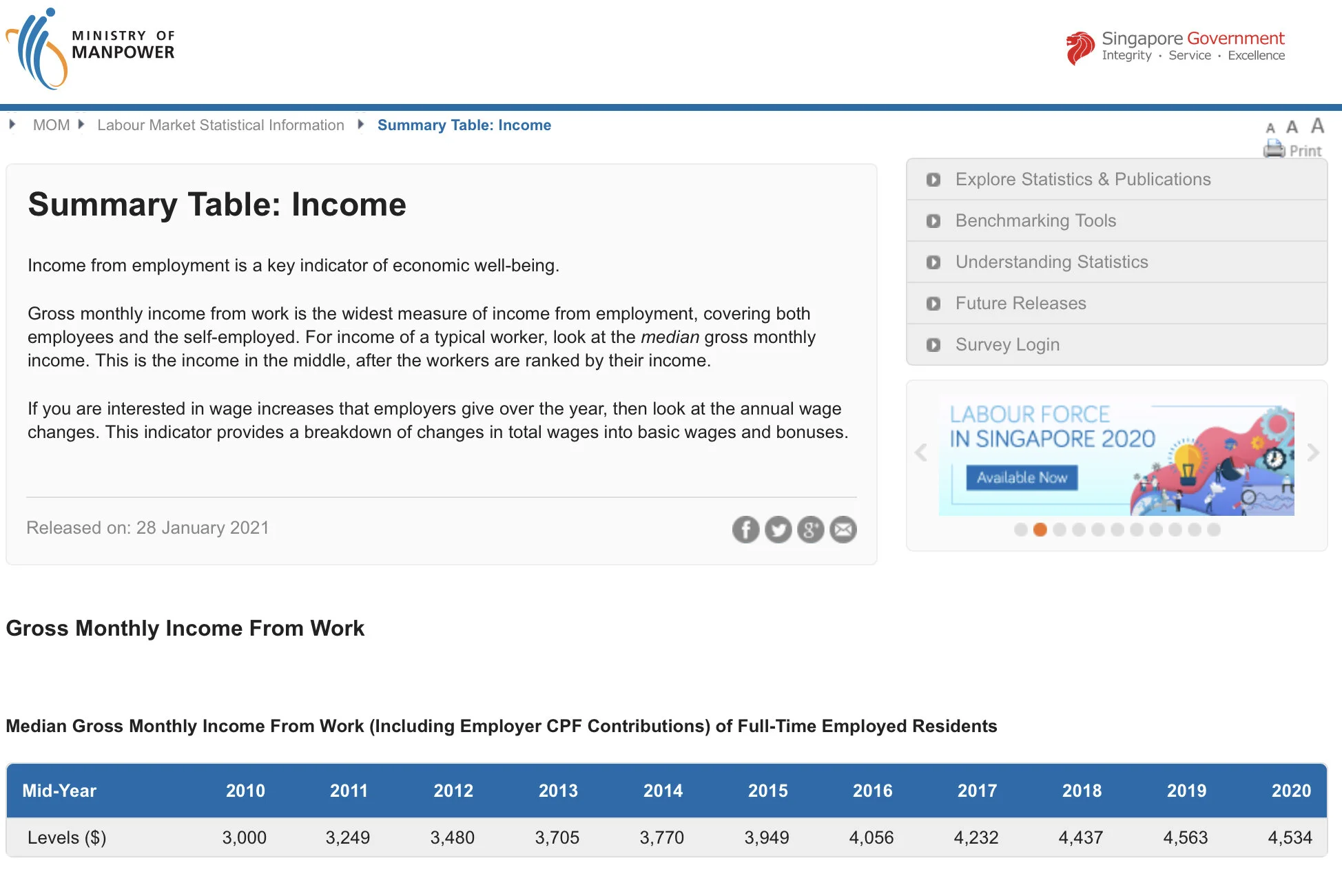

An average Singaporean earns a median gross income of $4,534 ( including CPF) according to the MOM income statistics report of 2020.

MOM Median Gross Monthly Income Statistics ( Source: MOM Website)

Let’s say he saves 20% of his income per month, which is $906.80

He if intends to get married to his partner which earns the same, they would save a total of $1813.60 a month.

How long would that take for them to afford a 4 room HDB flat? If we take $300,000 as the entry price of a 4 room BTO, it would take them 13 years to save up for the flat.

Of course, we are all aware that none of us does this.

We have our credit cards, our mobile phone subscriptions and we take loans to finance our homes. Being in debt, in my humble opinion, has become a necessity in our modern life.

But why is it when we talk about debt, it is still viewed by most as a “bad” thing?

When Debt is Bad

In his best selling book “Rich Dad, Poor Dad” ( recommended read ), Robert Kiyosaki puts it very clearly, bad debt takes money out of your pocket. Plain and simple. Any debt that you currently have that takes money out of your pocket every month, is considered bad.

Look at your bills every month, how many of them are considered bad debts?

If you are like 80% of the population, that would be 100%. Your car payments, credit card monthly payments, and most of the time even your mortgage payments.

Yes, you hear me right, even your mortgage payments.

You see, you pay interest to the bank to finance your house, and you get to stay in the house. Do you own the house completely? No, you own the right to stay in the house and you have the right to sell the house. It’s like renting but with more privileges.

If you have any doubts about this, try stopping the monthly payments and see what happens. If you took up an HDB loan, it may take a few months of being in arrears for the officers at HDB to take action. If you took a bank loan, it would be much faster.

In this case, if your house did not appreciate while you are staying in it, it generates nothing for you, your mortgage is bad debt.

Let’s take the following example.

Bad Debt Situation

James and Annie bought a 5 room resale HDB in Sengkang 5 years ago for $463,000. They took an HDB loan for 25 years and paid 25% upfront with their combined CPF. At the time of purchase, they were eligible for a family grant of $30,000.

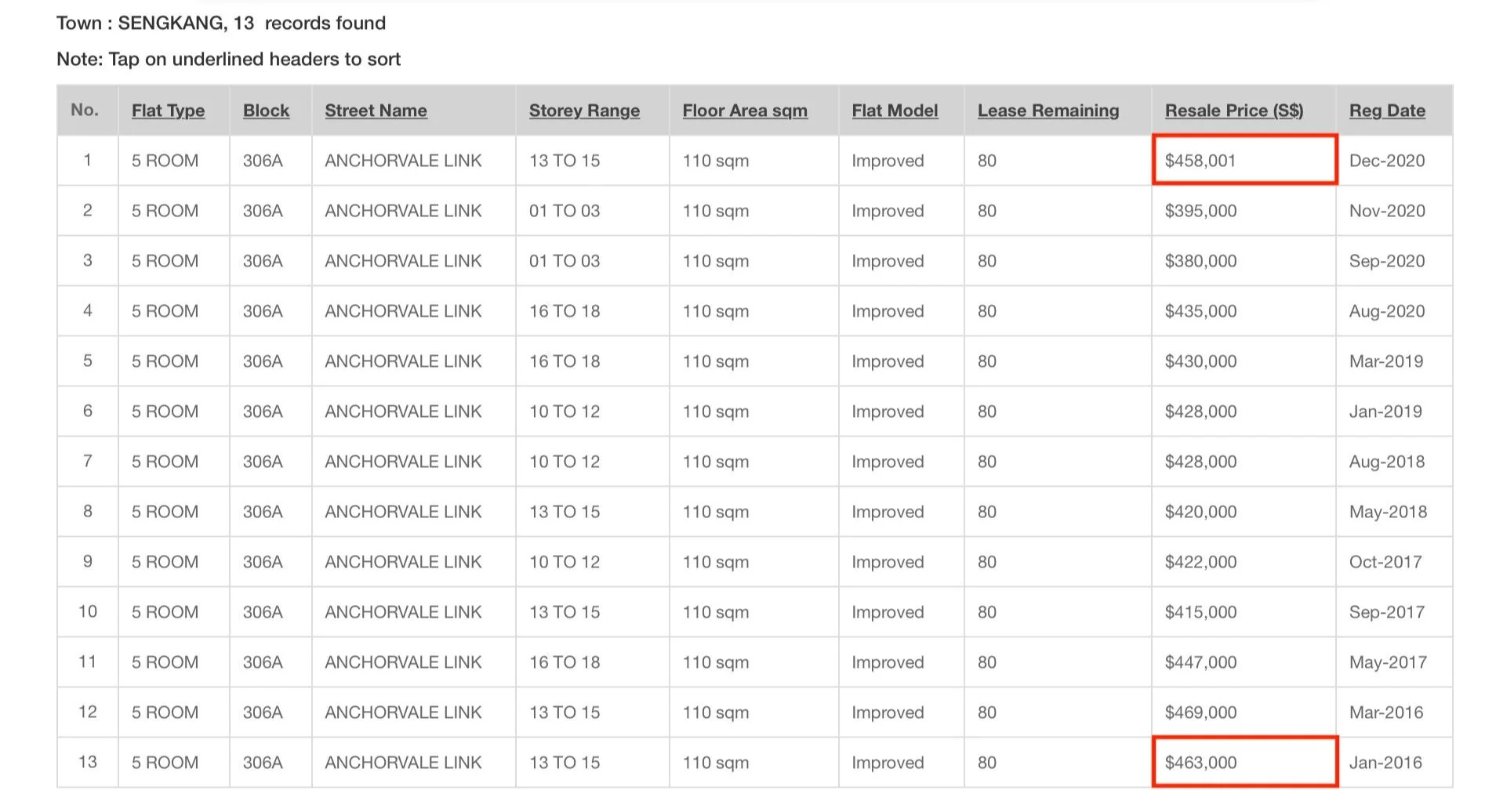

HDB Resale Transactions Example for the past 5 years

That makes their loan amount $317,250.

Their monthly payment will amount to $1,439.

Over 5 years, the accumulated interest amount would be $38.234.39.

Over the same period of 5 years, the price of their 5 room HDB stagnated. If they were to sell their house today at the same price of $463,000, they would have lost $38,324.39 to interest payments.

On top of that, because they used their CPF to pay for the deposit and the monthly mortgage payments, they would have to return to their CPF the amount used plus accrued interest.

The accrued interest in their case would be calculated as follows:

Year 1

($115,750 + $17,268) x 2.5% x 11/12 = $3,048.39

Year 2

($133,021 + $3048.39 + $17,268) x 2.5% = $3833.43

Year 3

($157,170 + $17,268 + $3833.43) x 2.5% = $4,456.78

Year 4

($178,271.43 + $17,268 + $4,456.78) x 2.5% = $4,999.90

Year 5

($199,996.21 + $17,268 + $4999.90) x 2.5% = $5556.58

Total accrued interest = $3048.39 + $3833.43 + 4456.78 + $4999.90 + $5556.58 = $21,895.08

And yes, acrued interest is compounding.

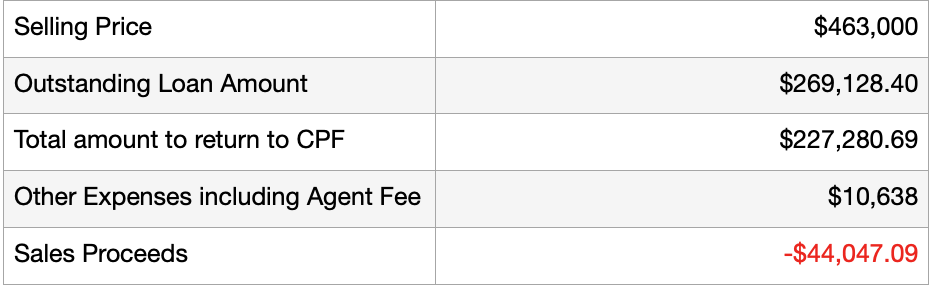

In the case of their sale, it will be a negative sale, meaning there will be no cash proceeds from the sales and they would have to choose to top-up the shortage amount using cash to their CPF or apply to waive it off.

Negative Sales Scenario

They could either cough up $44,047.09 of cash to top up their CPF or write it off and lose that amount altogether.

Those of you who are sharp might have noticed that I have omitted the buyer’s stamp duty they would have been subjected to when they bought the house. The buyer’s stamp duty in their case would be $8,490 at the rates back then. Let’s just say that they paid the buyer’s stamp duty in cash.

So in total, their loss on this property would be

$44,047.09 + $38,234.39 + $8,490 = $90,771.48

How would you feel if you were James or Annie and realised that after 5 years you have lost $90,000 staying in your property?

Not such a nice picture isn’t it?

A Better Situation

Now let’s look at another example, my very own example ( you can read more about it in my previous post here ).

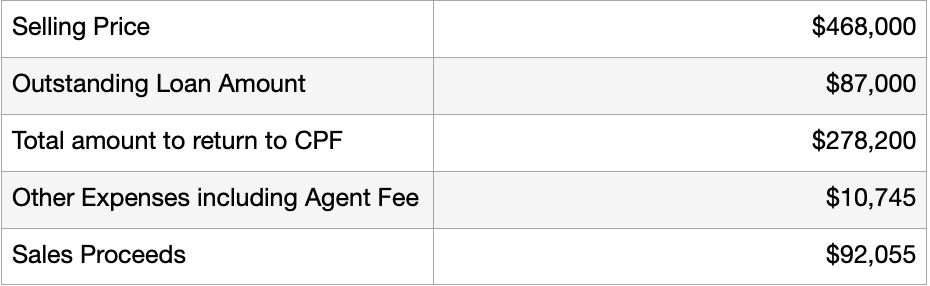

My wife and I bought a 4 Room BTO HDB Flat in Late 2011 and sold our flat in Jan 2020 right after it reached MOP. Our purchase price was $308,000 and our selling price was $468,000.

Positive Sale Scenario

In total, our profit from this sale would be

$92,055 - $4,360 (BSD) - $19,554 (Total Interest @ 2.6% rate) = $68,141

That is a staggering difference of $160,000! From a loss of $90,000 to a profit of $68,000.

This property had a gain of almost 51% over 8 years which worked out to be around 6.4% per year.

That is an example of a Good Debt situation. I got into debt with HDB and my property made me money.

Should I Avoid Resale Flats for My First Property?

The point that I am trying to make here is not to avoid buying resale flats altogether. We have different needs and some of us could not afford to wait for the BTO flats to be built and have to get a resale flat. With the current Covid-19 pandemic causing delays in the construction of BTO flats, it just worsened the waiting period.

A resale flat is still a very viable option for many in the current times, especially so with current CPF grants that go up to $160,000!

What should be done for resale home buyers is to understand the property that they are getting into and to know its potential for growth for the next 8-10 years.

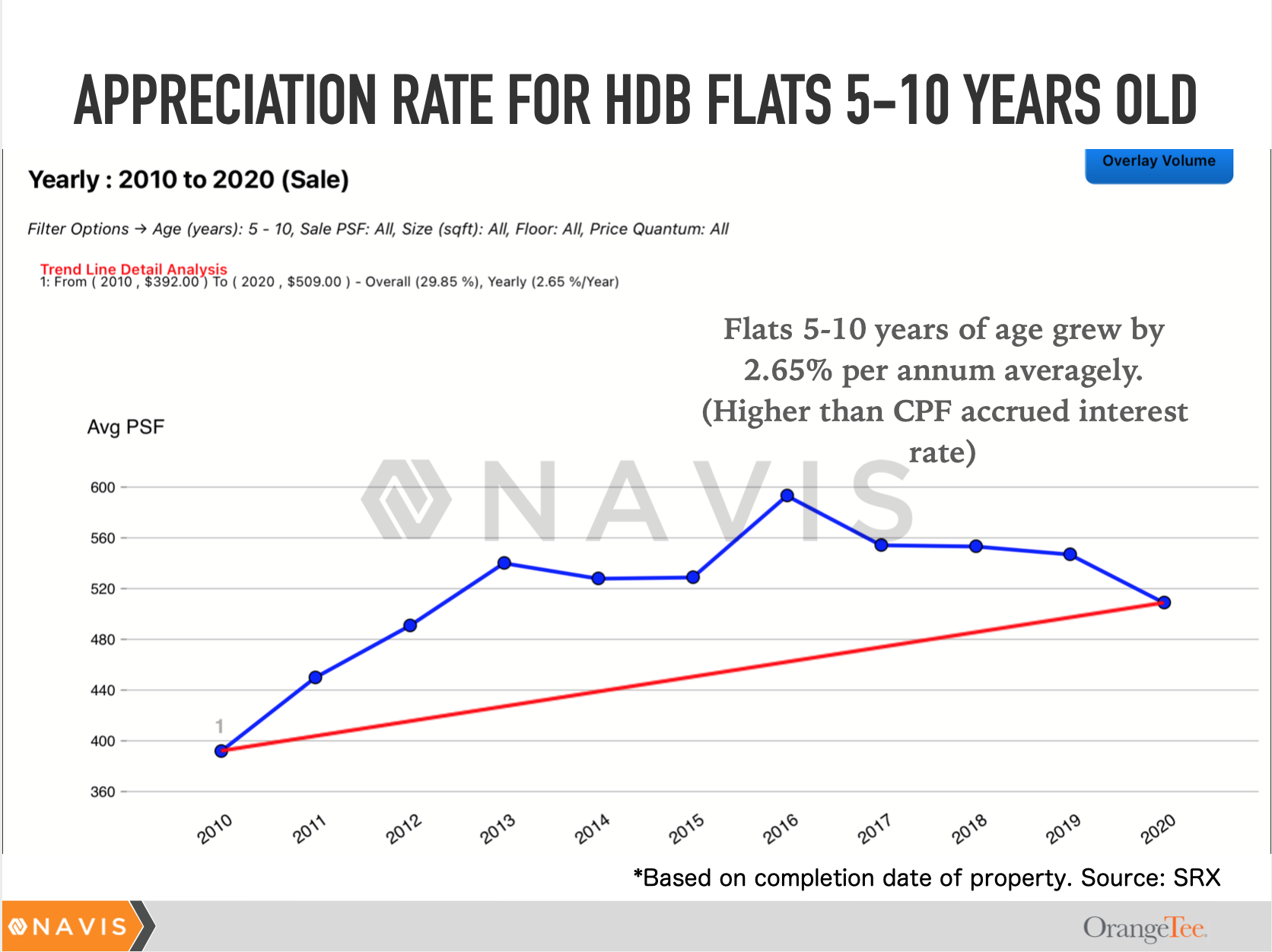

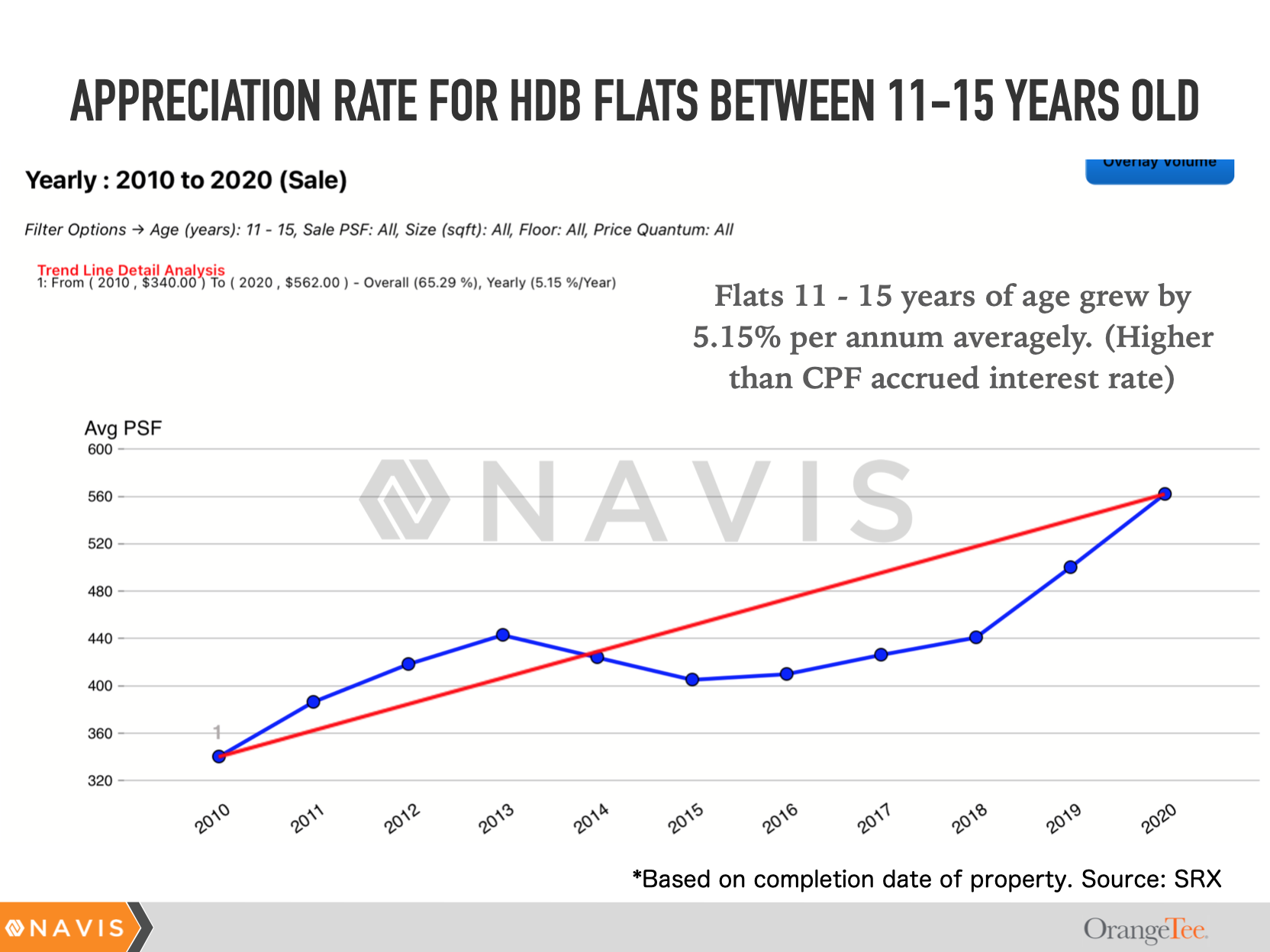

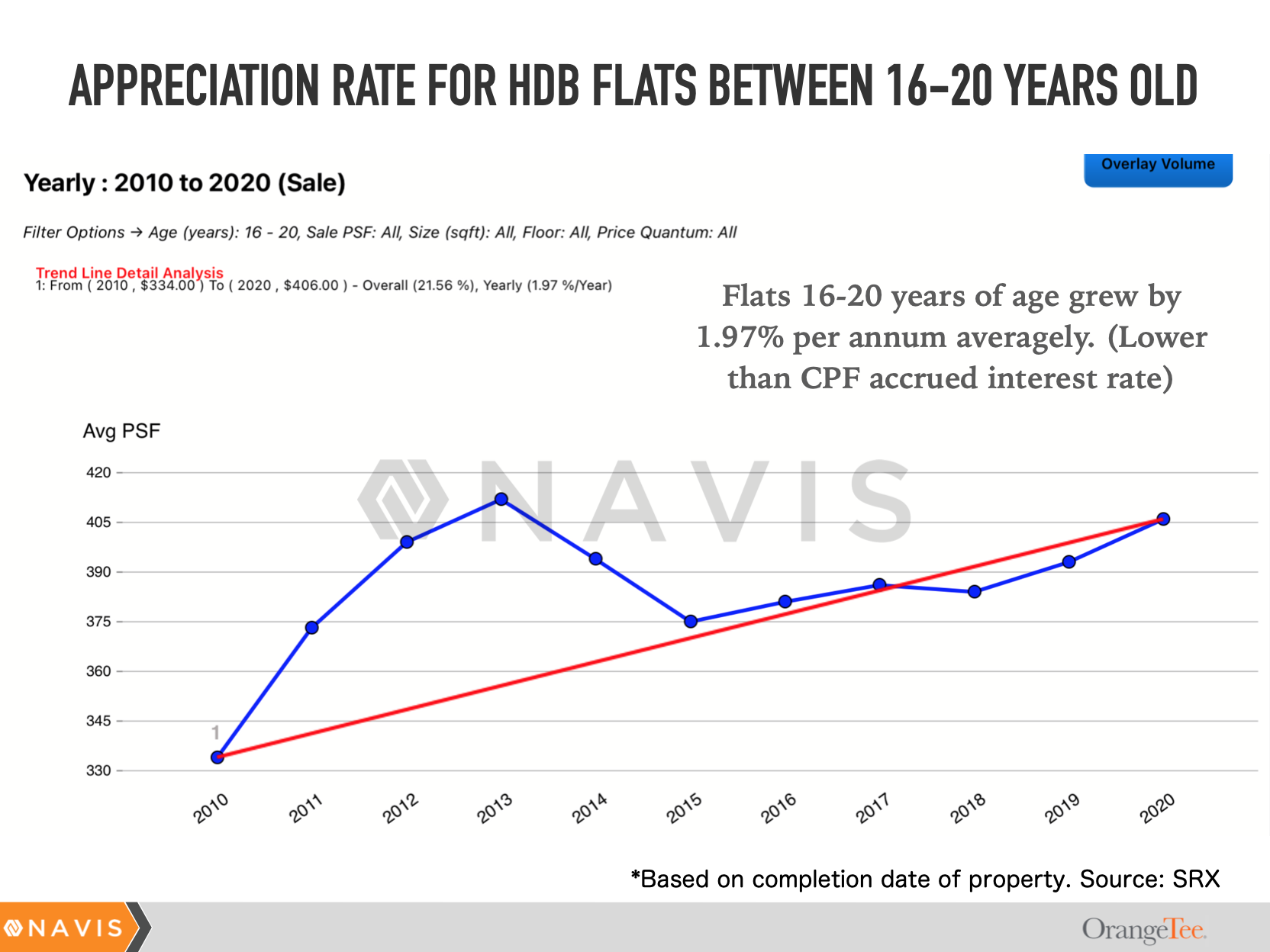

Below are 3 charts that depict the growth rate of an HDB flat over different periods.

HDB Growth from 5th to 10th Year

HDB Growth Rate 11th to 15th Year

HDB Growth 16th to 20th Year

These 3 charts depict the growth rate of HDBs in general during the year 2010 to 2020 and do not apply to ALL HDBs. Outliers like the prime HDB estates e.g. Pinnacle@Duxton or rare units like Jumbo HDB units might have appreciated more than the graph. Similarly, certain units might not share the same growth rate and might have stagnated earlier than the 16-20 year mark.

As you can see from the charts, in general, flats between 11-15 years old appreciated the most at 5.15% per annum.

This goes to show that resale flats age 15 years and younger tend to be the better choice if you are considering buying one for yourself. There are of course many other factors that come into play when selecting your property. For example, transport convenience, nearby amenities, primary and secondary school options, floor level, view, and so on.

Just be sure to give it a second thought if you are thinking of going into a property that is older and whether it is suitable for you in the long term.

The Real Good Debt Situation

My example is very atypical of every Singaporean who bought a BTO flat. It is almost 100% guaranteed that you will make money out of this first property.

The real question, however, is how do you ensure that your property continues to make money over the long term. The real deal is when you can allocate your capital into something that generates income for you on top of the appreciation of the capital itself.

Take this example.

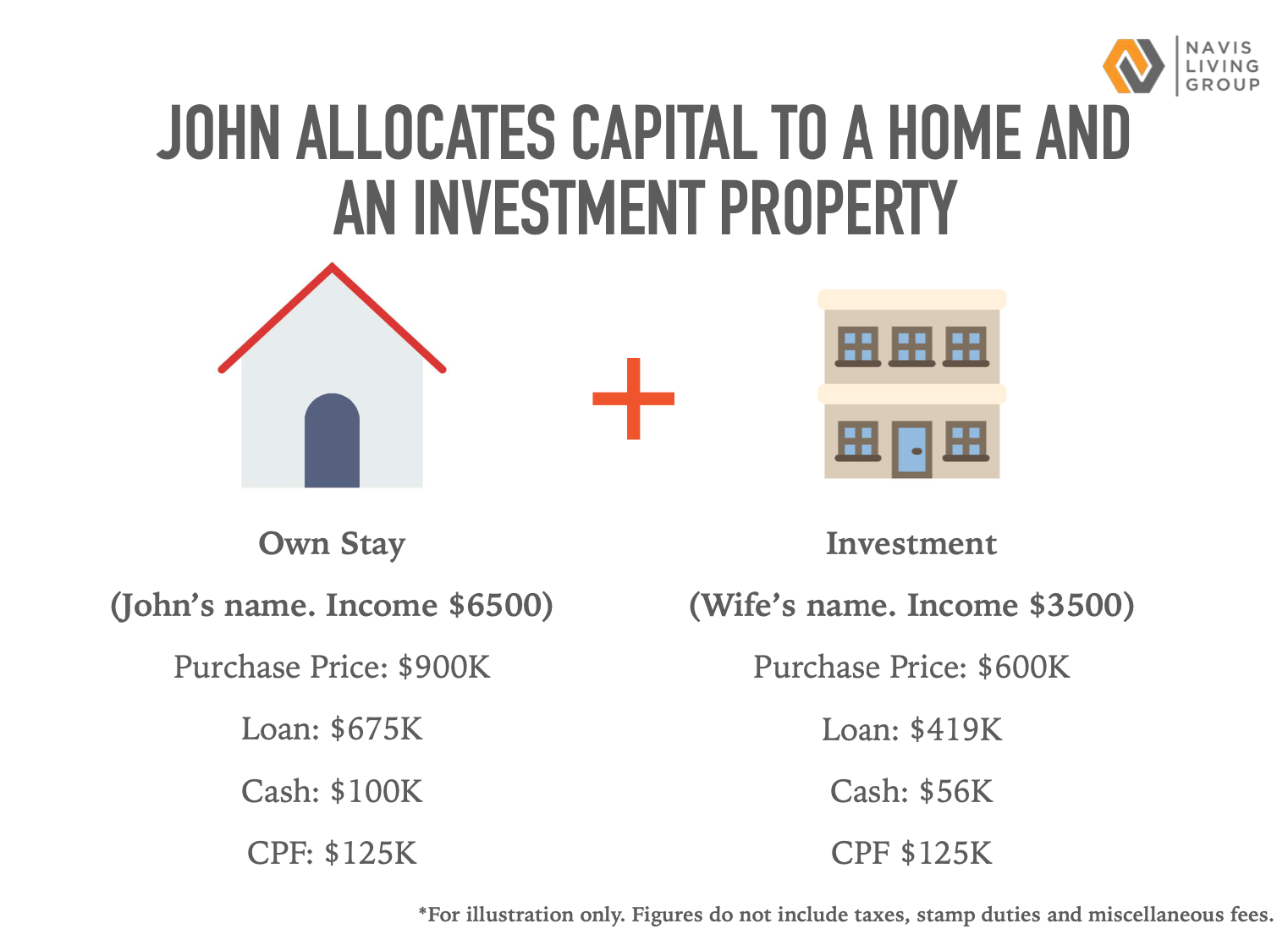

John and his wife, both 40 years old, currently own a 5 Room HDB Flat worth $620,000. They have 1 child age 6. They have a combined income of $10,000 per month.

Their HDB has an outstanding loan of $200,000 and their monthly instalments for this flat is $1,815 a month. ( assuming $400,000 HDB Loan @ 2.6% interest over 25 years ) If they sell the flat, they will be able to receive $420,000 sales proceeds, $260,000 in CPF, and $160,000 in cash.

Their flat is going to be 15 years old next year. What can they do?

John can choose to sell their flat and take the proceeds to buy 2 separate private properties under his name and his wife’s name. He will not have to pay any Additional Buyer’s Stamp Duties.

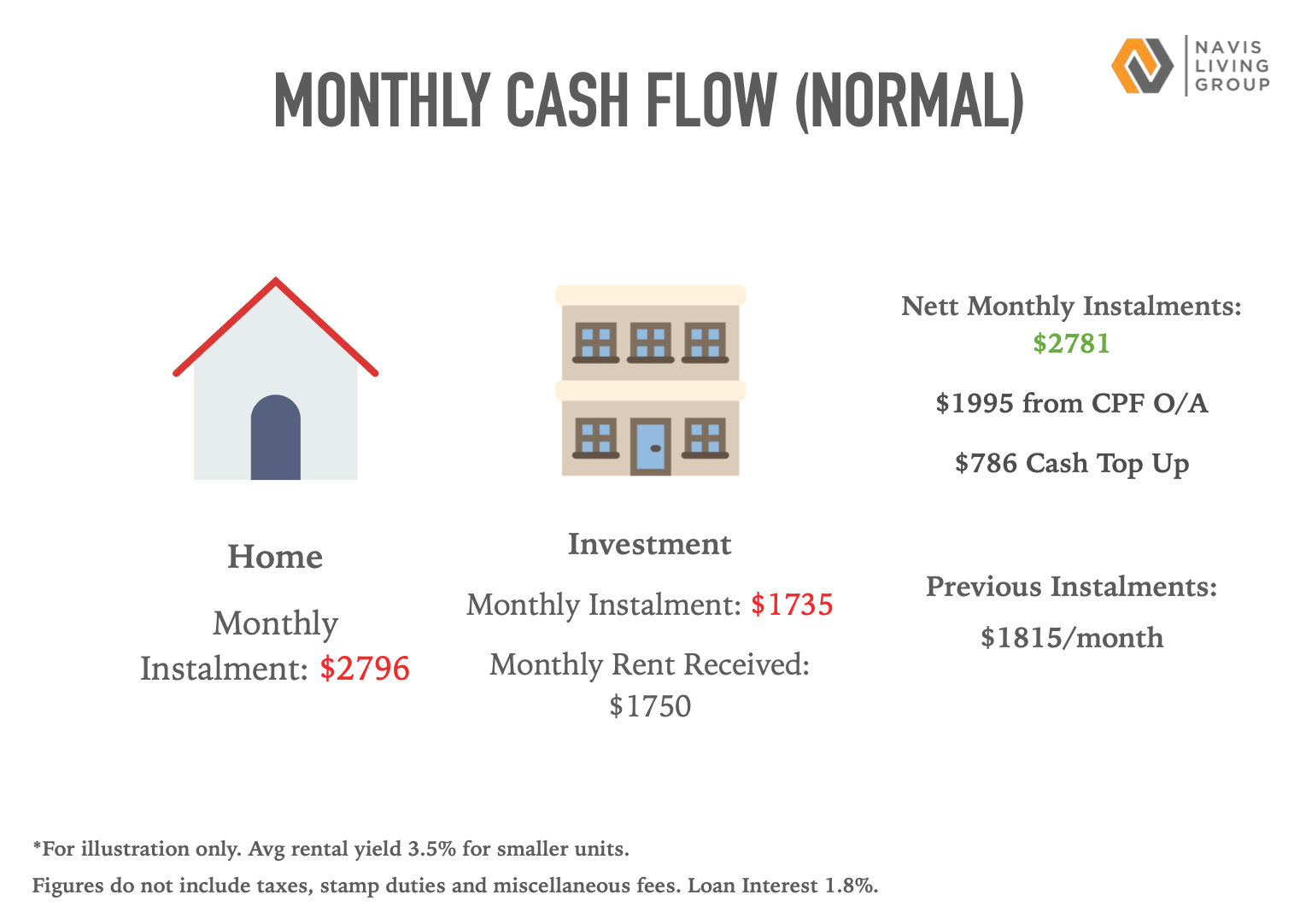

His monthly cash flow for these 2 properties will look like this.

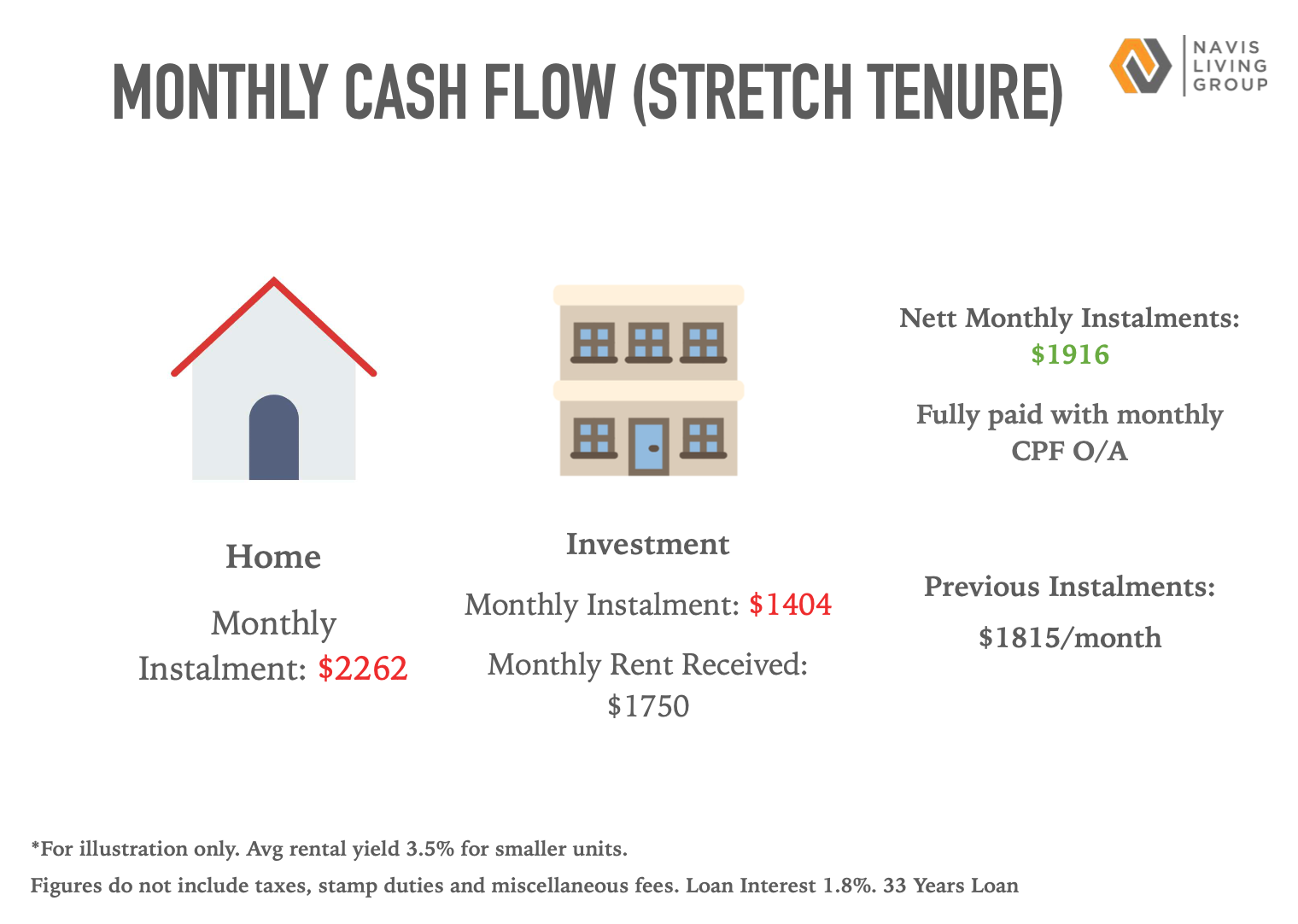

There will be an increase of $900 monthly for the instalments on both these properties. If they want it to be easier on the monthly, they can choose to stretch their tenure on their mortgage longer.

This will result in only a marginal increase of $100 in monthly instalments.

Instead of owning an HDB that is approaching its final years in growth potential, John and his wife will now own 2 private properties that are in their prime years of growth with one of them earning a healthy monthly cash flow of $346 for them.

Conclusion

The difference between good debt and bad debt is plain and simple. A Good Debt puts money in your pocket, a Bad Debt takes money out of your pocket.

You might be sitting on a Bad Property, thinking that it will still somehow make you money. You might be also sitting on a Good Property, that has the potential to unlock an even better way to help you grow your wealth. Either way, you have to take action to “see” what you might have missed out on over the years.

I hope this article has provided some valuable information to you, thank you for your time.

P.S. Pay your debts before the Chinese New Year, be a good person. Happy Chinese New Year! Gong Xi Fa Cai!