How To Know If Your Property Purchased With CPF Is Still Profitable

For a Singaporean, our CPF and our property is very much related. I have personally yet to come by any Singaporean who did not use CPF for their first property.

The sole aim of CPF is to make sure that our retirement is secured.

The sole aim for us should be to make sure that our retirement is secured too.

So its does makes sense for us to want our CPF money to work harder for us.

At 2.5% interest per annum for our OA account and 4% interest per annum for our SA account, is it difficult to find anything that give us such a stable return?

We are no strangers to news about HDBs selling above $1 million and private property owners earning 6-figure returns in a short 5-6 years.

So property is one such investment that can actually achieve a higher return than the CPF OA account.

But there are of course property owners who have lost money in their properties.

These property owners have either made a mistake of purchasing the wrong property for investment, or have held on to their property for far too long.

There is another group of property owners that are sitting in properties who think that their properties are still profitable, when in actual fact, they are already losing money holding them.

How do we determine whether a property is still making a profit and still worth holding?

What are the pointers that we should take note of when it comes to using our CPF for our property purchase and when should you move on to another property to maximise your return on your CPF used?

Let us delved in deeper in this week’s discussion.

The master formula

If a property is purchased with CPF, the profitability of the property is not simply measured by whether its growth is higher than the cost of owning it.

By cost of ownership, that will mean the cost of interest on your mortgage.

Generally, if the growth of your property is higher than the cost of owning it, your property is considered profitable.

Annual Property Growth - Annual Interest On Mortgage = Profits/Loss

Taking the following scenario:

Property Price - $500,000

Annual Growth 2.5% = $12,500

HDB Loan = $350,000

Annual Interest Payments = $8,980

Annual Property Growth - Annual Interest On Mortgage = Profits/Loss

$12,500 - $8,980 = $3,520 Profits

But when we add CPF into the equation, that will be a different story.

Our CPF money is suppose to generate 2.5% interest per annum when left in our OA account. This interest is paid for by the CPF Board.

When your CPF is used for your property, who pays for this 2.5% interest?

The answer is, your property, in the form of CPF accrued interest.

Adding on to the above scenario:

CPF Deposit Used - $150,000

Annual CPF Accrued Interest = $3,750

So since your property is suppose to pay your CPF Accrued interest, the formula will then look like this.

Annual Property Growth - Annual Interest On Mortgage - Annual CPF Accrued Interest = Profits/Loss

$12,500 - $8,980- $3,750 = -$230 Loss

Basically, we have to make sure that the growth of our property covers both the interest cost on mortgage and also CPF accrued interest.

Otherwise, we are actually making a loss on our property.

If your property type has not seen any growth for the past years, based on valuation and past transactions in your estate, development, then simply, it is time to move on to another property.

When your CPF is in your OA, CPF pays for your 2.5% interest on your OA monies.

When that CPF is in your property, your property is suppose to pay for it, whether you like it or not, this interest has to go back to your CPF account first, before its cashed out to you.

The loss on the above scenario might seem like its only $230, but in actual fact, it is more than that.

Opportunity cost

If you have moved your funds to another property that is growing at a healthy rate, it could look like this scenario:

Property Price - $1,200,000

Annual Growth 2.5% = $30,000

Bank Loan = $900,000

Annual Interest Payments = $13,335

CPF Deposit Used - $250,000

Annual CPF Accrued Interest = $6,250

Annual Property Growth - Annual Interest On Mortgage - Annual CPF Accrued Interest = Profits/Loss

$30,000 - $13,335 - $6250 = $10,415

Instead of making a loss of $230, you could potentially be making a profit of $10,415.

So in fact, if you continue to stay at a property that is not growing enough, you might be losing $10,000 or more a year.

This example is for a property that is still growing at the inflation rate of about 2.5%.

But what if your property is already at its stagnant stage?

What if instead of growing in value, it is declining in value?

The lost will just be even greater.

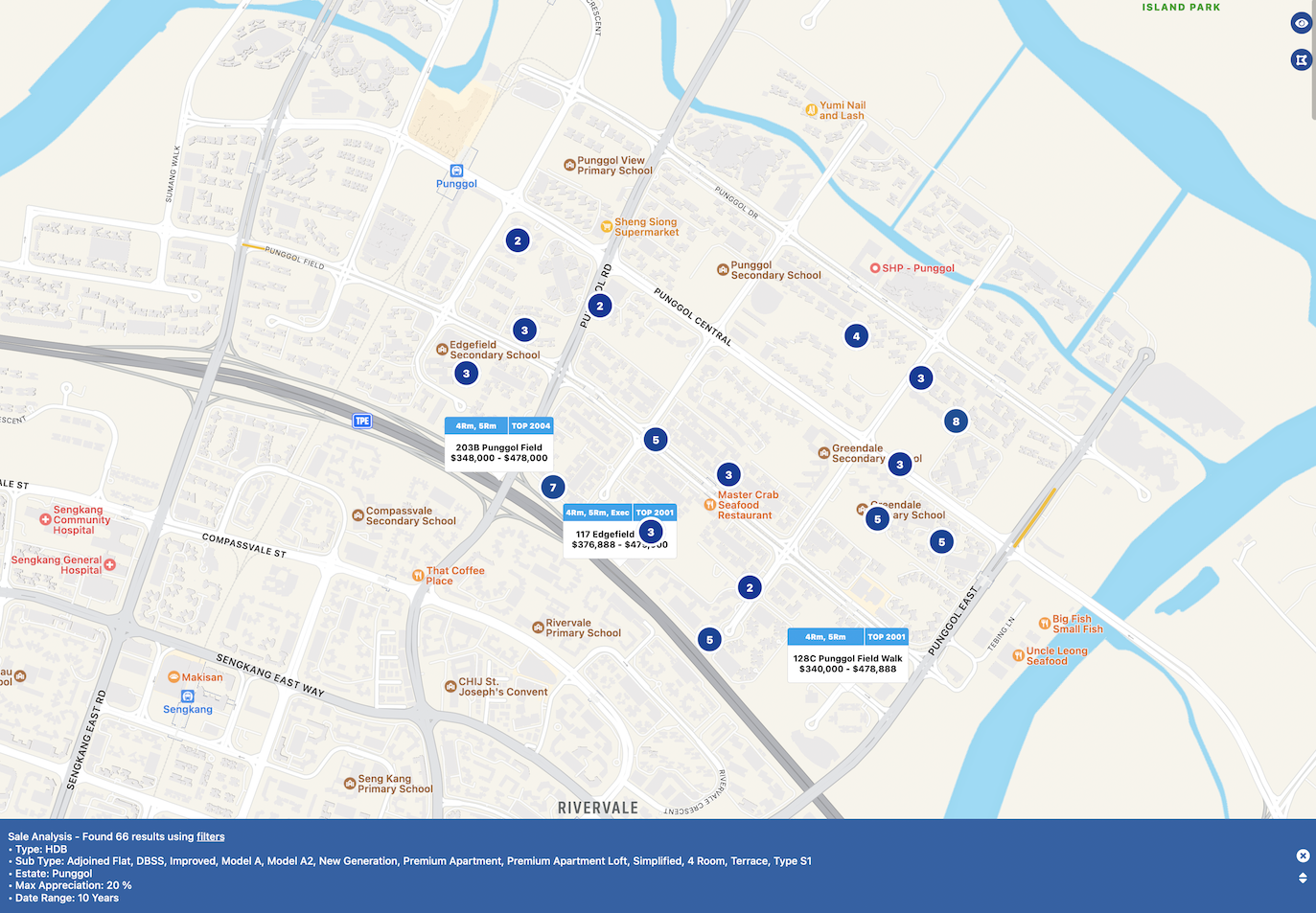

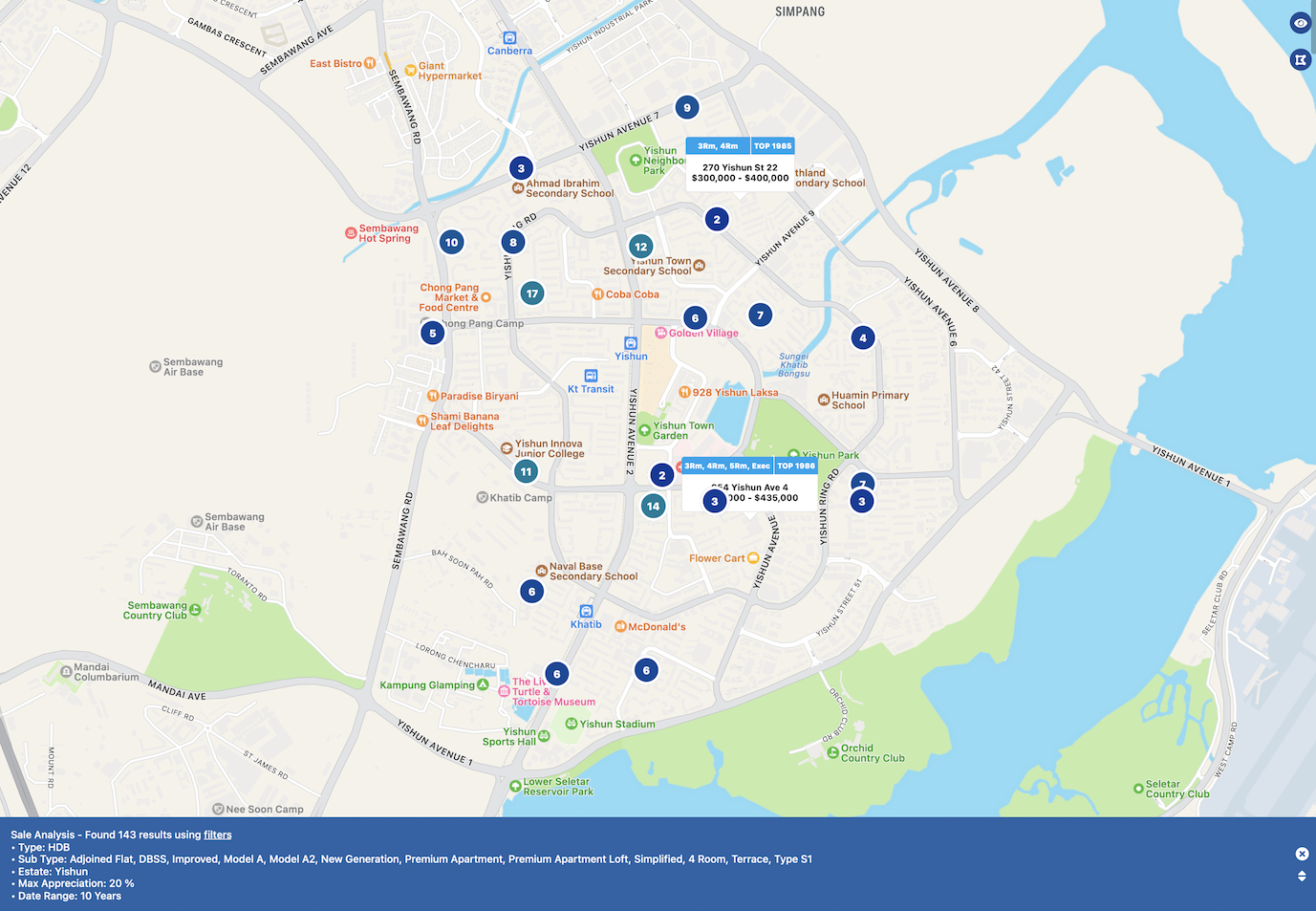

When I do a search in a few different HDB estates where the growth of the 4RM HDB in the area is less than 20% over a 10 Year Period, here are the results for Sengkang, Punggol, Ang Mo Kio and Yishun Respectively

107 Blocks in Sengkang Gained Less Than 20%

66 Blocks in Punggol Gained Less Than 20%

107 Blocks in Ang Mo Kio Gained Less Than 20%

143 Blocks in Yishun Gained Less Than 20%

And let’s not forget that it took a Global Pandemic that forced millions to work from home, huge disruption to supply chain, major slowdown in building times of new homes, shortage of labour, to begin driving prices up.

The factors that pushed up the prices were generally from the buyers who need a house and could not wait for the delay on their BTOs and buyers who need a larger space as they are constantly working from home.

This spurred a gain in interest for older resale flats that are generally bigger in size as compared to their newer counterparts.

But purchasing a older resale flat comes with a different form of risk when exiting in the future, more on this at a later post.

All 4 estates saw a loss in value up until Q2 2020

In fact, the average value of all 4 estates as mentioned saw a drop between 3% to 6% right up to the boom before Q2 2020.

As you can see in the graph above, the prices has largely been stagnant from 2014 to 2019.

What if the pandemic didn’t happen?

What would happen to the value of the houses then?

Conclusion

Annual Property Growth - Annual Interest On Mortgage - Annual CPF Accrued Interest = Profits/Loss

This simple formula will help you to see whether your property is actually still profitable and whether you should consider moving your capital into another property that can help you gain more in both CPF and Cash.

There are other cost involved when moving from one property to another, all those will just add on to the loss that you are already incurring.

If you find that you are already sitting on a property that is making a loss every year, do consider whether there is a better property that you can move your funds to.

If you need assistance on that, contact me by clicking below to schedule a one to one free consultation so that I can help you with it.