Are Properties Still A Good Form Of Investment?

As inflation climbs and uncertainty mounts in the west, coupled with the ongoing war between Russia and Ukraine, everyone is looking for a safe and stable investment to park our hard-earned money.

Most of us will agree that properties in Singapore are one of the safest forms of investment available to us.

However, with the recent changes announced in the Budget 2022 highlighting an increase in property taxes and the cooling measures introduced last December, are properties still a good investment choice in terms of the returns you can get?

Let’s look into it more together.

First, what makes Singapore properties a safe form of investment?

Low volatility

Not everyone has the mental capacity to go through the emotional rollercoaster of watching your investments go from highs to lows in a matter of days.

The rise of cryptocurrencies has made it even more gruelling with prices spiking and tanking within a matter of minutes!

Most people who have their hard-earned money for retirement in these forms of investments will very likely be in a state of panic and sell-off, resulting in huge losses. When selling off and stopping further losses involves just the click of a few buttons, its makes it even harder to resist cutting the investment.

It takes time to sell a property.

By the time you were to go through the process of engaging an agent and listing your property for sale, the initial panic of the downturn would have passed.

Furthermore, an investment property that is rented out will likely be able to generate a rental that can cover most, if not all of the mortgage payments on the property.

To learn how to find properties like that, reach out to us here.

Even in the case of a market downturn, owners will not rush to sell when they see a paper loss because most of them will not be worried about not making the mortgage payments.

Property being illiquid becomes an advantage in this way.

Investments are meant for the long term, and when you are caught in the emotional fear of loss in the short term, it is easy to lose sight of what your investment is meant to do for you.

That’s what a property investment can do for you.

Strength and Resilience of Singapore's Property Market

Singapore's economic strength and the stability we created with the different cooling measures over the years ensures that property owners are not over-leveraged.

Property owners will have more holding power during times of market correction, even more so with a tenant managing the bulk of the mortgage payments.

These measures prevent a big market sell-off during a crisis, thus making the drops in the property market even more manageable.

Looking back at the downturns in the private non-landed segment over the last 20 years, it took a much shorter time to recover from the recent downturns as compared to the dot-com bubble and the 2008 Financial Crisis.

Market Trend for Non-landed Private Properties since 2000

Also, the drop in the market is not as drastic as what we have seen before cooling measures were introduced.

In fact, the market correction in 2013 was due to the introduction of the Total Debt Servicing Ratio, not a crisis.

The most recent Covid-19 pandemic also caused a slowdown that lasted just a few months before prices rise back up again.

It took many years of trial and errors and careful regulations to reach the stability that we have in our property market now and this is something that an investor can safely count on.

Property is a Physical Asset

Being a physical asset, property owners can take active steps to increase the value of their property.

Any renovations, remodelling and additional furnishings to the property will increase the value that a potential buyer sees in the property.

Even with just a fresh coat of paint, buyers will mentally put a higher value on the property when they compare it with another similar property that did not have the painting work done.

Painting can do wonders!

Owners will also be able to increase the value of their property when they are selling their property by engaging an agent that can provide home-staging services, video home tours and 360 virtual tours that can again increase the value home buyers sees in the property.

Usually, small investments like these can effectively increase the selling price by tens of thousands of dollars.

Property owners can also improve the furnishings and provide additional items for tenants so that they can command a higher rental in the market.

There are many things that a property owner can do to actively increase its value, even temporarily during the sale of the property, to yield a higher return on their investment.

Even the simple act of leaving behind furnishings and electronics that you no longer need can also be used as a way to negotiate for a much higher price than the value of the items left behind!

Now that we have explored the ways how a property is a much safer form of investment as compared to the stock market, crypto-currencies even your savings in the bank, let us talk about returns.

Ultimately, investments have to generate a good return to be worthwhile. Otherwise, it makes no sense no matter how safe it is.

Returns of a Property Investment

For Singapore’s property market in general, an investor will take into consideration 2 different forms of returns.

Rental Yield

Capital Appreciation

Rental Yield and Capital Gains make up the full return of a property investment

A property investment, in my opinion, has to fulfil both types of returns in order to be considered a good one.

Rental yield is the standard way that most people use to evaluate the returns of a property investment. It takes into account the annual gross rental income against the purchase price of the property.

But due to the fact that we can use a high leverage to acquire properties, we should be using a different way of calculating it.

The Right Way To Calculate Rental Yield

Commonly, investors calculate rental yield using the following formula:

Rental Yield = Annual Rental Income / Purchase Price of Property

So if your monthly rental income is $1,800 per month for your $800,000 investment 1 Bedder Unit, your gross rental yield will be 2.7%.

An investment property also takes on several expenses of its own, monthly maintenance, cost of interest on loan and property taxes, just to name a few.

After taking into consideration the expenses, we might arrive at just 0.8% net rental yield on the property.

Wait a minute, 0.8%? I might as well put my money into fixed deposit accounts!

Yes it might look like the rental yield is 0.8% and I would agree for you to just stash your money into a fixed deposit account if it is just 0.8% net rental yield.

But is it really?

How much did you actually paid when you bought the property?

Base on the current loan to value ( LTV )regulations, you can effectively borrow up to 75% of the property’s purchase price.

For a $800,000 property, you would need to fork out the following to purchase the property.

Cash outlay of a 1 bedroom resale private condominium

5% Cash Deposit - $40,000

20% CPF/Cash Deposit - $160,000

Buyer’s Stamp Duty - $18,600

Legal Fees - $3,500

Total - $222,100

That’s all that you would have paid when you purchased the investment property.

So, since that is all that you have paid for the property, the formula we should use is actually

Net Annual Rental Income / Amount Paid for the Property = Net Rental Yield

$6,840 / $222,100 ( The actual amount paid during purchase ) = 3.07%

This gives us a net rental yield of 3%!

Now that we have the right formula to calculate the net rental yield, let us look at capital appreciation.

Capital Appreciation

The wonderful thing about investment properties is while you have only paid a fraction of the purchase price of the property, capital appreciation applies to the actual value of the property!

When I did a search of the entire island with 1 bedders that is less than $800,000 with capital appreciation of min 6% over the past 2 years, I received 85 results!

To learn how our platform can assist you to find properties like these easily, contact us here.

That means there are at least 85 developments that have units that grew more than 3% per annum, at a minimum.

You just have to know where to find the right ones.

There you go, with a rental yield of 3% and an annual appreciation of 3%

That gives us a return of 6% per year.

6% is a really decent return for an investment that is so safe and stable.

Of course, there might be other factors that might cause the rental yield and the capital appreciation to fluctuate, but because there are 2 different form of returns, you are better covered.

As we have discussed above, you can choose to hold on to the property for a longer period of time during market downturns and consider lowering the monthly rental during periods of low tenant-ability as well.

There are measures that will help you hold the investment until the market recovers and get more out of what you are paying for.

One such measure will be refinancing and stretching tenure on the property.

Conclusion

While the returns on a property investment might not be as high as what you can get from a riskier investment, it is seriously worth considering if you want a long-term, safe and stable investment.

It terms of returns, it is definitely on par, if not better than putting your money in your CPF account, which returns 2.5% to 5% for the different accounts.

The cooling measures that were introduced in Dec 2021 are mainly targeted towards foreign investors and entities. Taking the precautionary step that foreign investors might rush back into Singapore’s property market once the pandemic restrictions are eased.

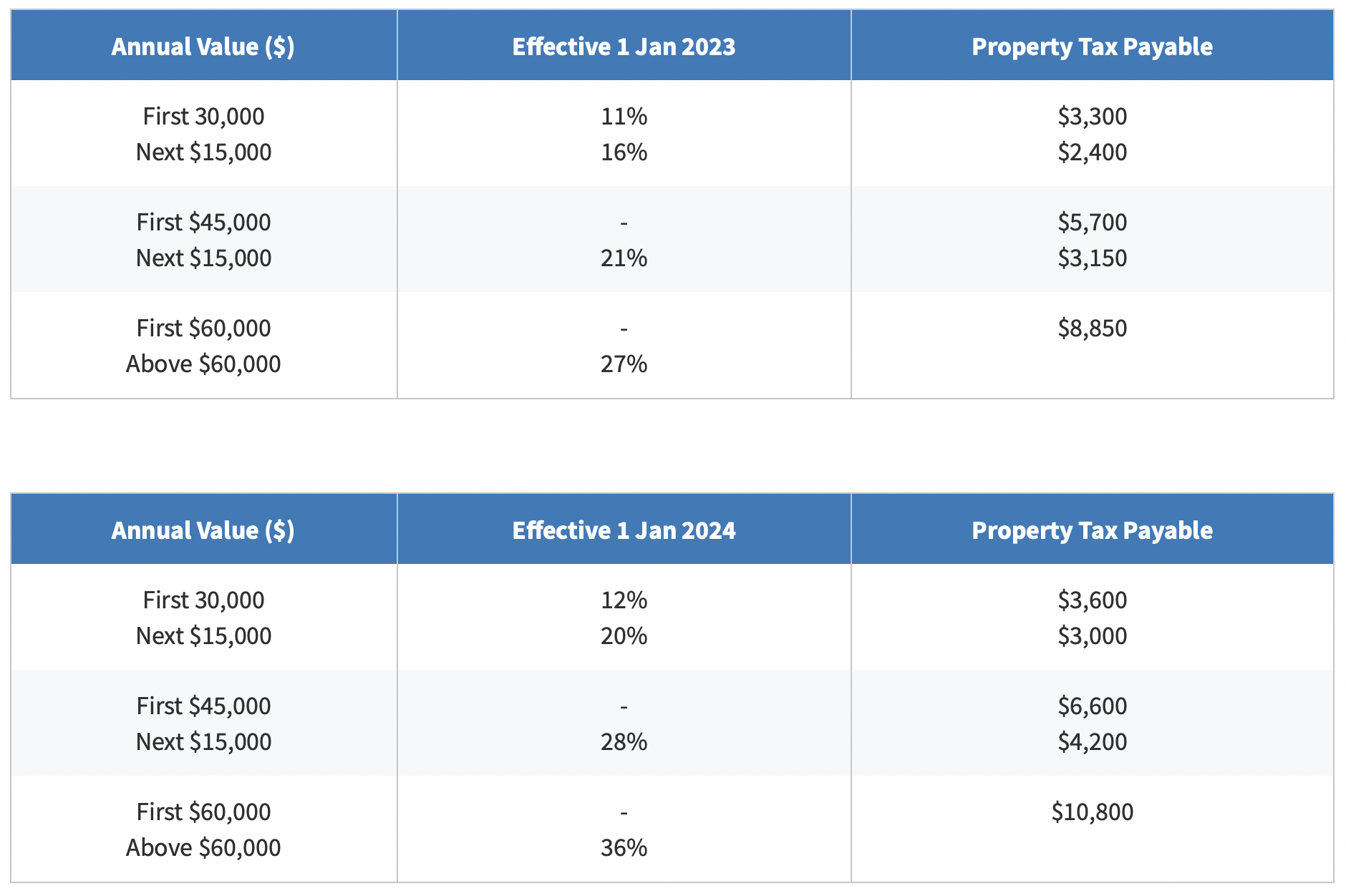

The recently announced increase in property tax will also mainly impacting bigger homes in general with annual value above $30,000.

Non-owner occupied tax rates starting from from 2023 to 2024

Even if your investment property is of a higher annual value due to its location or size, you will still be able to find the right property with good rental yield and future growth to make your investment worthwhile.

If you want to learn how you can find the right property with both good rental yield and good future capital appreciation, book a consultation session with me by clicking below.