Why is Singapore’s Market Strong and Resilient?

Back in 2017, a report from DBS caused quite a stir when they forecasted New Private Property Prices to hit a high of $2,300 to $2,900 in the year 2030. They have since issued an updated Overall Outlook Report in May 2023 which you can read here.

They couldn’t have forecasted the pandemic and predicted the bull market from 2021 to 2023, but with prices at what they are today, it seems that their forecast may even be short.

Today, we see average CCR prices at $3,151 PSF, RCR at $2,635 PSF and OCR at $2,151 PSF respectively. The upper range of the forecast of $2,900 PSF has been breached and the lower range of $2,300 PSF is not too far off.

And we are still 6 years away from 2030.

Will the market continue its rise to 2030 and surpass what was forecasted?

Our property market is very different from that of other countries and many elements are unique to Singapore. Let us take a look at what makes us Uniquely Singapore.

Cooling Measures

Although different countries have different policies to manage the property market, I believe none are as highly involved as Singapore’s government.

To date, there are a total of 15 official rounds of cooling measures, to summarise, here are the current key cooling measures that are in place

Loan to Value

Currently at up to 75% for first private property and up to 45% for second property

LTV of 80% for HDB

Stamp Duties

Seller Stamp Duties

Source: IRAS

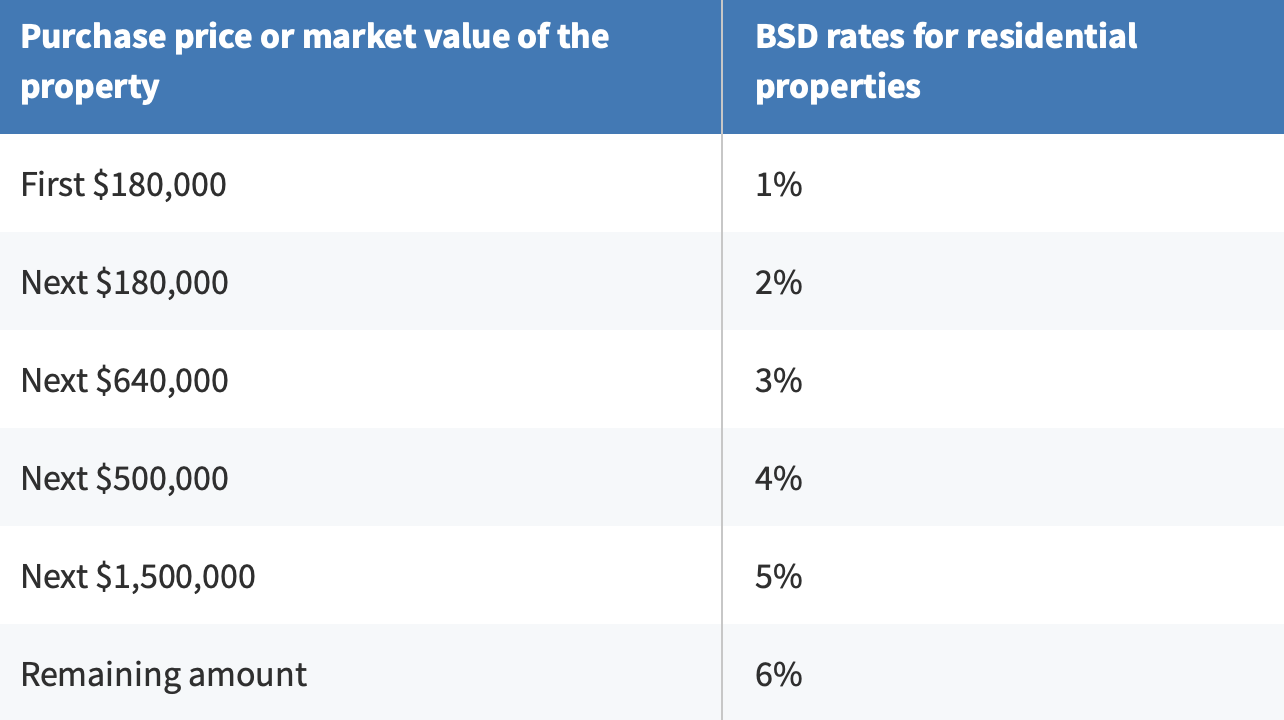

Buyer’s Stamp Duties

Source: IRAS

Additional Buyer Stamp Duties

Source: IRAS

Borrowing Restrictions

This limits the amount an individual can loan based on their income. For private properties, the TDSR framework is applied which allows for 55% of an individual’s monthly income, minus outstanding loan obligations, including car loans and other personal loans, to be used to calculate loan eligibility.

For HDB Buyers, the MSR framework is applied where 30% of gross income is being used to calculate loan eligibility.

Another borrowing restriction banks have to adhere to is the loan stress test rate. Where they use a base rate of 4% for private property loans and 3% for HDB loans to determine loan eligibility, regardless of current mortgage rates.

Buying Restrictions

HDB 15-month wait-out periods for Private Owners to purchase resale HDBs and 30-month wait-out period for Private Owners to purchase subsidized housing, including BTO and brand new ECs.

All these cooling measures are in place to prevent speculation, restrict leveraging and keep foreign funds from flooding into the property market.

At the same time, these cooling measures also created a very stable foundation for the market. Most property owners are not over-leveraged.

DBS reports that households are generally well capitalized, with average loan-to-value coming in at 35%-38%. Additionally, with the banks’ mortgage book loan-to-values (LTVs) averaging 50%-60%, these factors eliminate the chance of a systemic risk impacting the property market.

Source: Singstat

Household net worth has continued to grow year on year and liabilities are dropping as well.

All these indicate that the cooling measures have done their job over the past 10 years and created a market where owners are not over-leveraged and will likely be able to sustain mortgage commitments for their own-stay properties.

Property investors will also be able to offset their mortgage obligations by renting out any property that they hold.

If owners do not see a need to sell at a lower price since they can sustain or wait out any possible economic event in the future, the likely direction of the market movement would be up.

Controlled Supply, Increasing Demand

Singapore is tiny and land is scarce, naturally, our supply of housing is limited. According to Singstat.gov.sg, we have a total of 1,125,605 HDBs, 351,179 Condos and Apartments and 75,222 Landed properties as of June 2023.

Source: Singstat

Our population growth has been revised and will no longer be at 6.9 million by 2030. This has been reiterated many times by the government.

Source: gov.sg

But we can be pretty certain that the amount of housing needed will continue to go up, even if our population does not grow to 6.9 million by 2030.

The government will steadily increase the supply of housing according to the demands of the market.

When there is a need to, they can choose to ramp up the Government Land Sales and increase the number of BTOs being built. They can also choose to tighten it when they see the need to.

Even if private developers are to go to the en-bloc market for land supplies, they can also moderate the bids by adjusting development charges and lease topping-up fees.

There will not be a situation where lands are rampantly released just to bring in revenue to the government, which happens in some countries

Source: URA

With this much control over the land supply, it is unlikely to run into an oversupply situation, thus keeping the property market stable.

Government Subsidy and Grants

Revamped in 2019, the framework of CPF Housing Grants, Enhanced Housing Grants and Proximity Grants significantly increased the amount of grants resale HDB buyers can get when buying their first home.

This injection of grants has added a huge amount of value into the HDB resale market since 2019, slowly fueling the price of resale HDBs. Since then, resale HDBs has seen a price growth of nearly 40%, surpassing the past high in 2013.

The constant supply of BTO and subsidies for these homes also brings about a push in the housing market when the BTO flats reached MOP and seller realise the market value of those flats.

< New Plus and Prime Housing Models, are they suitable for you? Read more here >

As HDBs forms the foundation for Singapore’s property market, the increased value will bring about a rise in affordability and thus, prices of private properties will also go up when these HDB owners aspire to upgrade.

High home ownership

Singapore is among the world’s top few countries with the highest homeownership rate of close to 90%. This means that Singapore’s properties are mostly being bought by Singaporeans for their stay. We do not rely on foreign purchases to float the market the opposite is needed to keep the market on a stable growth so that it remains affordable for the majority of the population.

Conclusion

With all these elements in play, it is highly unlikely that Singapore will find itself in a situation like 2008 where prices plunge drastically when property owners need to quickly sell off their holdings as they cannot afford to hold the property anymore due to high borrowing costs or over-leveraging.

Property owners now can wait and see when major events are happening around the world and the government has lots of play in its books to stabilize the market if anything drastic were to happen.

The recent pandemic is a very clear indication that Singapore’s property market is in a league of its own and cannot be compared with the property markets of other countries.

If you are interested in a more in-depth outlook on the property market in 2024 and beyond, click here, and let’s have a chat.