Will the brand new ECs still have the lottery effect?

Buy EC won’t go wrong; confirm that you will make money when you sell in the future; it's like winning the lottery!

You will not be a stranger to this statement if you have ever discussed it with anyone about buying an executive condominium.

And this statement is indeed true. For first-time EC buyers, nearly all of them made money when selling their EC in the resale market.

One of the owners of an EC in Tampines made a whopping $1.35m profit in just 9 years!

It is a penthouse unit and also one of the biggest units in the development, standing at 3864 sq ft.

In terms of PSF growth, it is not the unit with the highest growth. There are many units that outperform it in terms of PSF growth. But because of the sheer size of the unit, the profit quantum is massive.

This previous owner bought this unit during its launch for less than $500 PSF.

Those were the days.

Reminiscing the old days of $500 PSF?

Looking back, it was definitely a no-brainer to buy an EC if you could fulfil the eligibility criteria and afford it.

But the question is, will it still happen to the new ECs that are bought at the current prices?

Source: Business Times

Lumina Grand that went on sale last weekend saw 53% of their units snapped up at launch, which is no easy feat considering the average PSF of $1,464 PSF. The smallest 3BR unit at 936 square feet will cost upwards of $1.35 million.

Comparing it to Sol Acres, which launched in 2015, the average price of a mid-floor unit of a similar size was around $730,000. That is a difference of more than $500,000 if you compare it to a mid floor 3BR unit which would roughly cost $1.35 million based on the average price.

Let’s look back in time when Sol Acres was launched back in 2015.

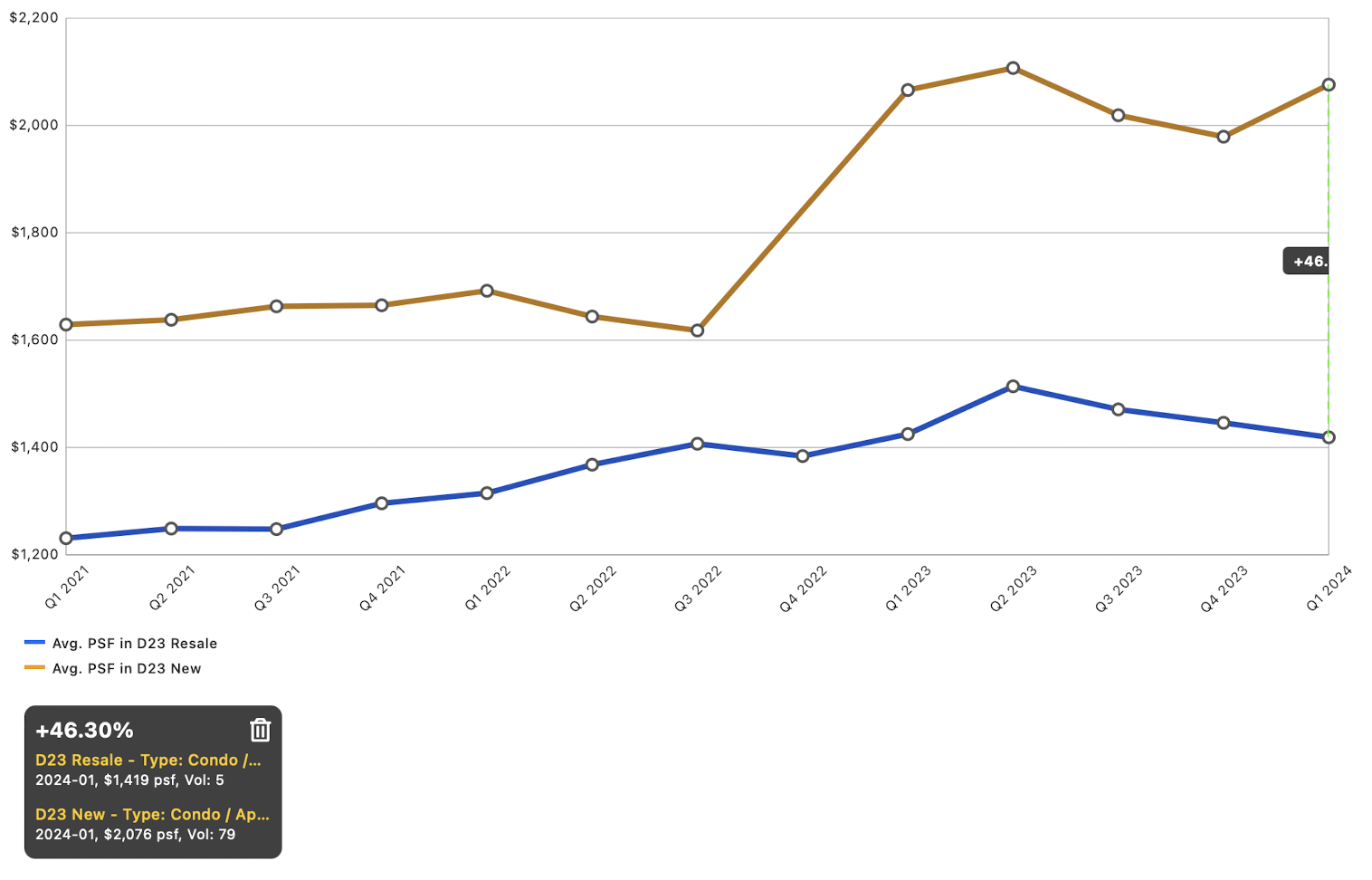

Source: Huttons Analyzer

Sol Acres was launched in 2015 as a brand new EC and sold at an average price of $785 PSF for their units.

New launches in D23 were averaging $1,256 PSF, and resale units were going for an average of $1,057 PSF.

The was a gap of $471 PSF and $199 PSF, respectively as compared to the launch price of Sol Acres then. Sol Acres was launched as a Brand New EC but at a lower price than resale condos. This already gave it a very big advantage against the resale condos when it comes time to hit the resale market too.

Source: Huttons Analyzer

Now, new launch prices in D23 are at a record high, with the average going at $2,076 PSF and resale prices have also hit $1,419 PSF.

The gap between New Launches is widen now to $612 PSF but prices against resale has shrunk to just $45 PSF.

While $1,464 PSF might seem expensive for an EC, if you consider the price difference between the New Launch Private Condos which are over $600 PSF more, it is considered a steal.

Although the price of resale units is now lower than the price of Lumina Grand, it is still not so far apart that makes it unappealing to future buyers.

However, the catch is that there is another 5 years of waiting for the MOP before owners can begin to sell their units, so we will not see the numbers until close to 10 years later.

But if we are follow this trend, there are 2 likely scenarios that will happen.

Scenario 1 - A cheaper, comparable option to a similar private condo

When buyers hunt for a unit 10 years later, Lumina Grand will have a tremendous advantage in terms of pricing against similar private condos launched today. Owners can effectively adjust their selling prices up to $600 PSF lower than the private condos and still make a decent profit. This will easily swing buyers over to Lumina Grand.

Scenario 2 - Similarly price to a resale, but new and better

In 10 years, the current resale units will be at least 15 to 20 years old. Buyers who are considering those units will definitely be enticed to look towards Lumina Grand instead, as the pricing would be quite similar given that the average price difference now is only $45 PSF. They will be getting a 5-year-old unit instead of a 20-year-old unit; it will be quite an obvious choice.

Of course, there will be other factors that come into play that will determine whether Lumina Grand will be favoured in the future. Examples like build quality, building management, actual unit layout, and facing will determine its pricing in the future. But having this huge price gap between the current new launches and the close-to-nothing gap between the current resale units will definitely be its huge advantage.

There is another obvious advantage for Singaporeans who are eligible to buy an EC now. The obvious advantage is the difference in affordability when it comes to the resale market.

New EC buyers are subjected to MSR when evaluating their loan eligibility, but when the unit hits the resale market, the resale buyers will be evaluated based on TDSR for their loan eligibility.

This will allow the resale buyers to take a much bigger loan when purchasing the EC unit in the resale market.

This would mean that the resale buyers would not need such a large down payment as compared to the first-time buyers.

In conclusion, if you are one of the few that are able to purchase a brand new EC, you will still be in for quite a decent profit in the future.

P.S. Take note that buying a unit in an EC is still similar to buying a unit in any new launch development. To maximise your future profit, the fundamentals of picking the right unit are still important. If you would like a detailed walkthrough for picking the right unit, reach out to us here!